List of benefits being an Australian Permanent Resident

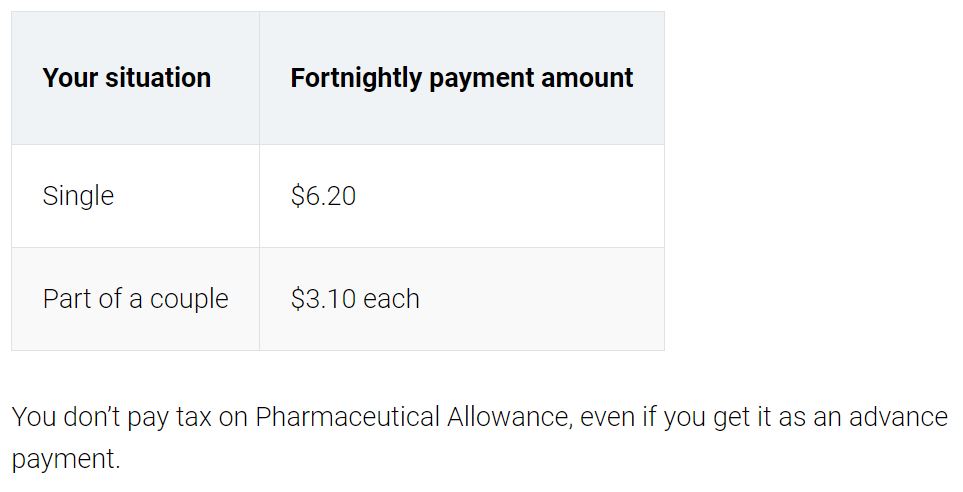

1. Pharmaceutical Allowance

Get a regular extra payment up to AUD$6.20 per fortnight to help with medicine costs if you get certain payments from the government.

Read here for full eligibility.

2. Pensioner Concession Card

Read here for full eligibility.

Be 60 years or older to get cheaper health care and some discounts which include:

- cheaper medicine under the Pharmaceutical Benefits Scheme

- bulk billed doctor visits – this is up to your doctor

- a bigger refund for medical costs when you reach the Medicare Safety Net

- help with hearing services – read more about the Hearing Services Program

- discounts to redirect your mail through Australia Post.

Your state or territory government and local council may offer you more. They may lower your:

- utility bills

- property and water rates

- public transport fare

- motor vehicle registration

- train fare.

3. Commonwealth Seniors Health Card

Read here for full eligibility.

Be 66 years or older to get cheaper health care and some discounts which include:

- cheaper medicine under the Pharmaceutical Benefits Scheme

- bulk billed doctor visits – this is up to your doctor

- a bigger refund for medical costs when you reach the Medicare Safety Net.

Your state or territory government and local council may offer you more. They may lower any of these expenses:

- electricity and gas bills

- property and water rates

- health care costs, including ambulance, dental and eye care

- public transport fare.

4. Newborn Upfront Payment and Newborn Supplement

Get a lump-sum payment of AUD$560 per child for Upfront Payment + Supplement up to AUD $1,679.86 (first child) or AUD$560.56 (subsequent children) for the 13 weeks in total.

Read here for full eligibility.

5. Dad and Partner Pay

Get a payment of minimum AUD$740.60 per week before tax for up to 2 weeks while you care for your new child.

Read here for full eligibility.

6. Parental Leave Pay

Get a payment of minimum AUD$740.60 per week before tax for up to 18 weeks while you care for your new child.

Your partner may also be eligible for Dad and Partner Pay for up to 2 weeks. This means your family can receive a total of up to 20 weeks pay.

Read here for full eligibility.

7. Parenting Payment

Get up to AUD$780.70 income support payment while you’re a young child’s main carer.

Read here for full eligibility.

8. Child Care Subsidy

Get up to 85% subsidise on your hourly fee/rate cap of Child Care for a child 13 or younger.

Read here for full eligibility.

9. Family Tax Benefit

You may be eligible if you care for your child at least 35% of the time and meet the income test.

Read here for full eligibility.

Family Tax Benefit (FTB) Part A for each eligible child

The maximum rate for each child per fortnight is:

$186.20 for a child 0 to 12 years

$242.20 for a child 13 to 15 years

$242.20 for a child 16 to 19 years who meets the study requirements

$59.78 for a child 0 to 19 years in an approved care organization.

Family Tax Benefit (FTB) Part B per family

The maximum rate per family each fortnight is:

$158.34 when the youngest child is 0 to 5 years of age

$110.60 when the youngest child is 5 to 18 years of age.

10. Education Entry Payment

Get a lump sum taxable payment of $208 a year when you start to study. Only for those who get certain income support from the government.

Read here for full eligibility.

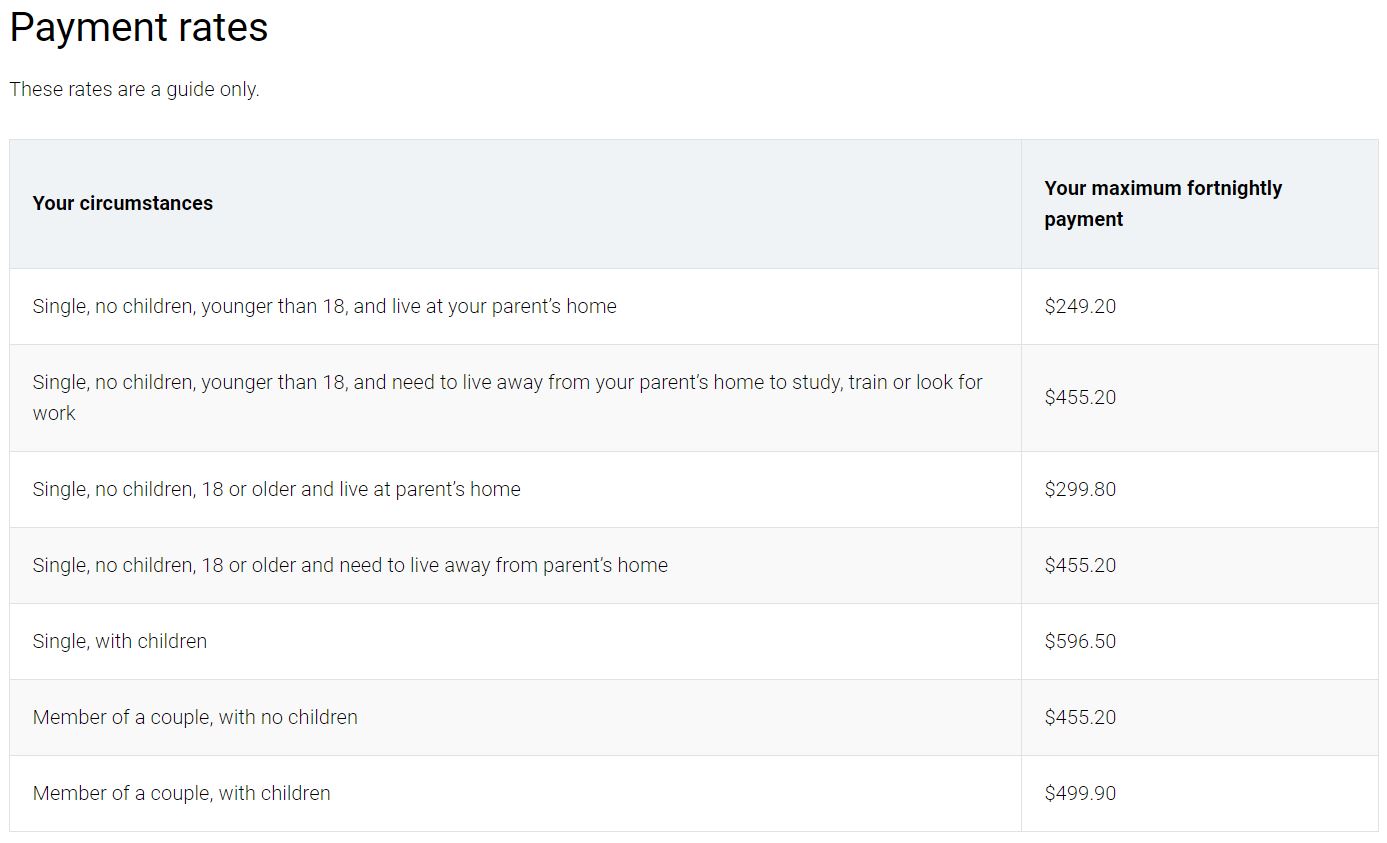

11. Youth Allowance

Get up to AUD$596.50 per fortnight financial help if you’re 24 or younger and a student or Australian Apprentice.

Read here for full eligibility.

12. Austudy Income

Get up to AUD$455.20 per fortnight financial help if you’re 25 or older and studying or an Australian Apprentice.

Read here for full eligibility.

13. Relocation Scholarship

Get up to AUD$4,553 a year payment if you move to or from a regional or remote area for higher education study.

Read here for full eligibility.

If your family home is in a regional or remote area, You’ll get

$4,553 in the first year you need to live away from home to study

$2,278 per year in the second and third years

$1,138 per year after that.

If your family home isn’t in a regional or remote area but your course is, You’ll get:

$4,553 in the first year you need to live away from home to study

$1,138 per year after that.

If your family home and your course are in major cities

Even if they’re in different cities, you won’t be eligible for this payment.

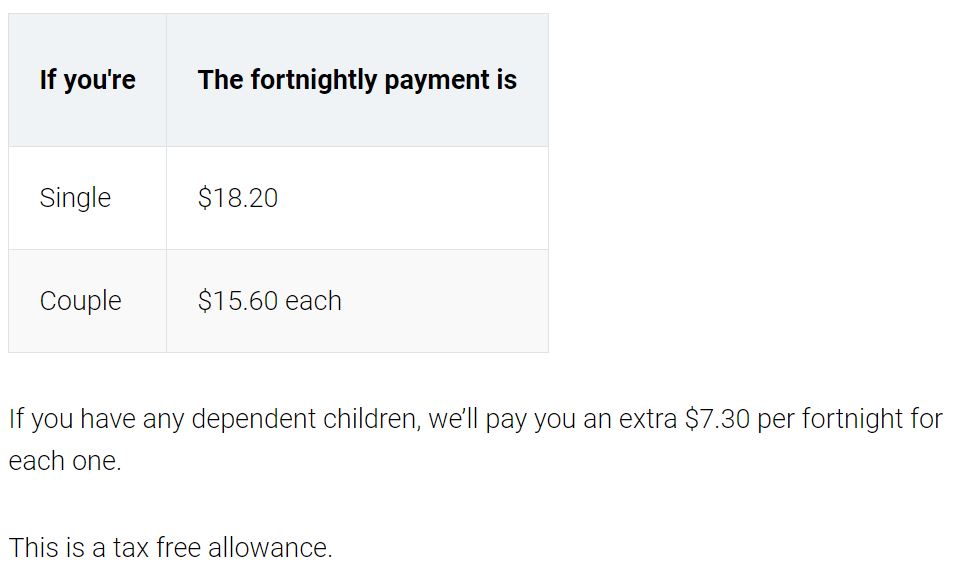

14. Remote Area Allowance

Get up to AUD$18.20 regular extra payment per fortnight if you live in a remote area.

Read here for full eligibility.

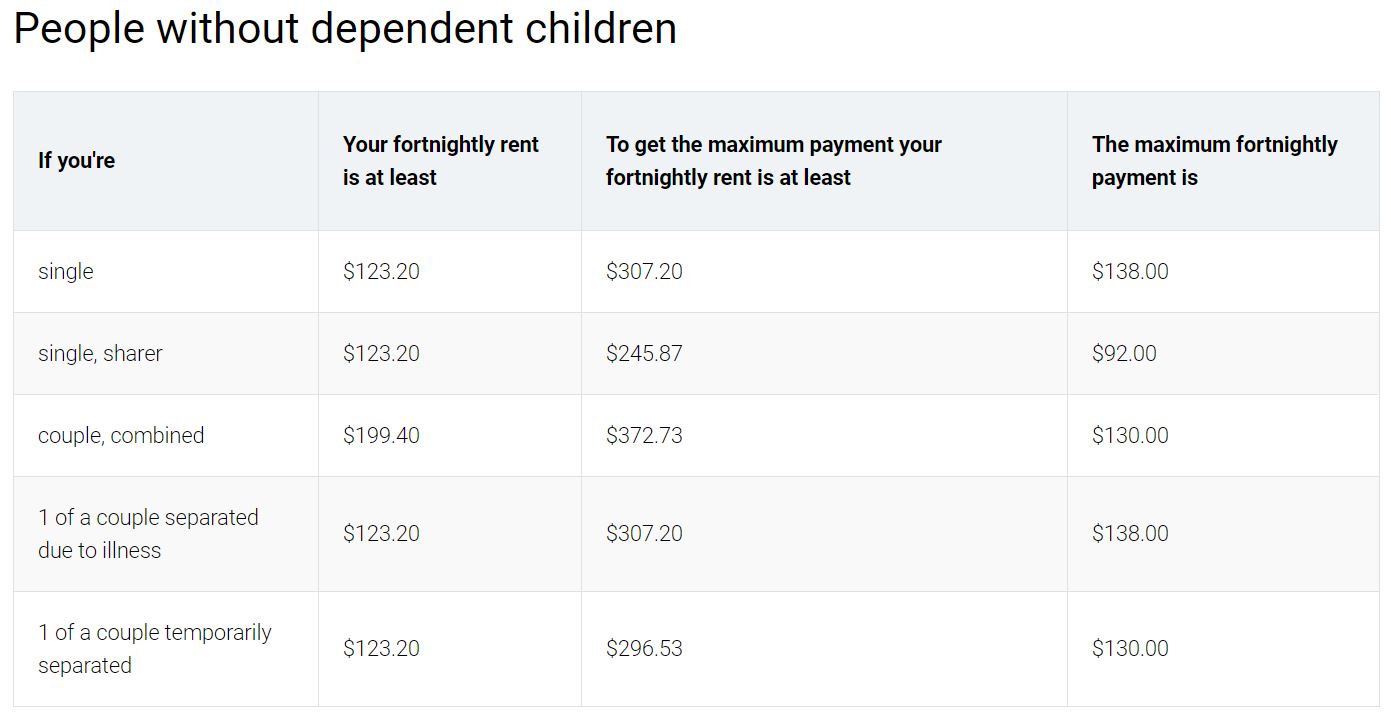

15. Rent Assistance

For every $1 of rent you pay above the minimum rent, you’ll get 75c.

Read here for full eligibility.

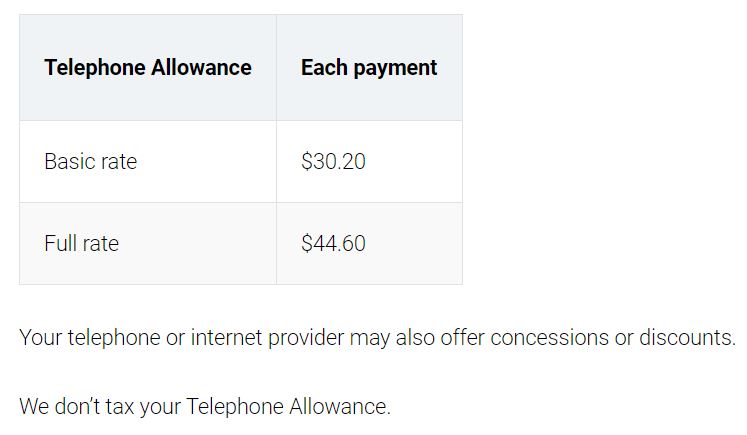

16.Telephone Allowance

Get up to AUD$44.60 quarterly payment to help with phone and internet costs.

Read here for full eligibility.

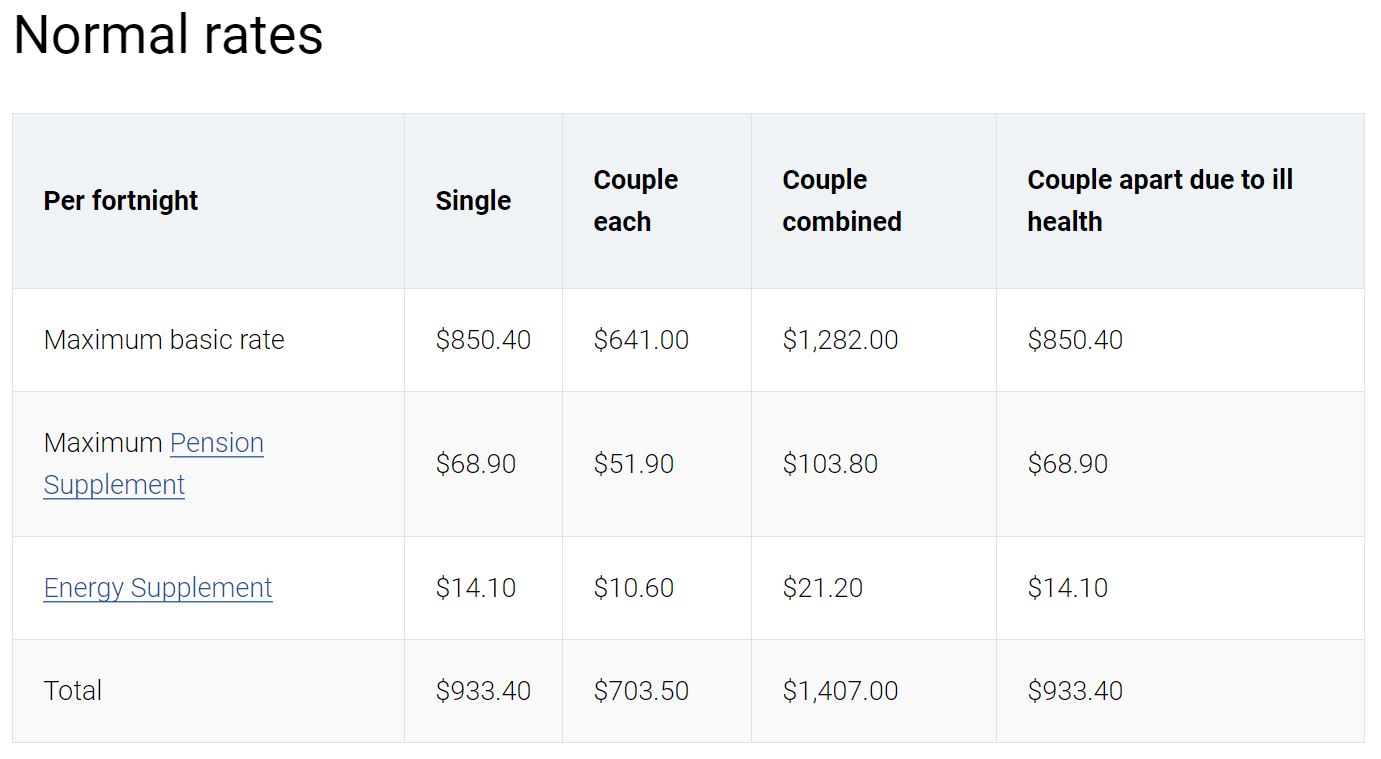

17. Age Pension Income

Get up to AUD$933.40 (Single) or AUD$1,407.00 (Couple) per fortnight when you reach 66 years or older.

Read here for full eligibility.

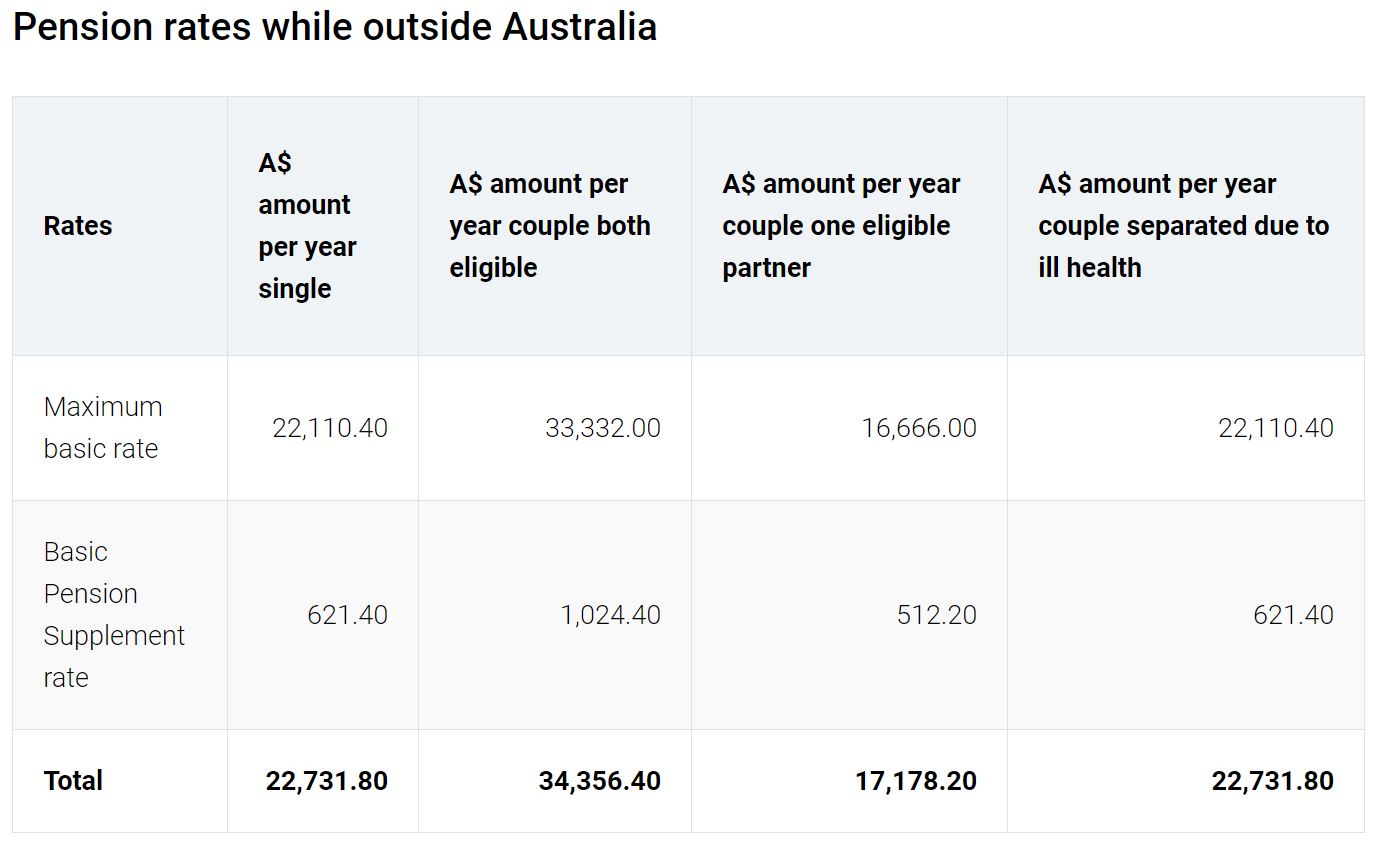

18. International Social Security

Get paid for your pension if you live outside Australia permanently or are outside Australia on along term basis.

Read here for full eligibility.